Salary calculation > Period reports, Payroll ledger, Salary lists

...

It's important to notice, that period reports and salary calculations can display different information. The reason is that the period report retrieves data for the official notifications on the basis of the payment date, and the chosen period of time can have several salary calculations. Pay date (maksupäivä) is the same that is used in Tulorekisteri.

You can find a more detailed payment date specific breakdown in the Salary lists tab. Employee specific breakdown can be found in the Payroll ledger tab. Salary calculation, in turn, is always an individual one, and the search period is directed to salary season marked in the payslip regardless of the date of payment.

| Iframe | ||

|---|---|---|

|

...

|

...

|

...

|

...

Table of Contents

...

Period reports

Salary calculation > Period reports

In Period reports tab, you can form period reports and modify them to files for example, for accounting systems and tax authorities or print the reports.

...

It is important that, when you want to download authority reports, the time range has been selected correctly. If a calendar month is selected, a monthly report is downloaded. And if a calendar year is selected, a yearly report is downloaded.

NOTE! Since the beginning of year 2019 using Income Register (more information here) has replaced the earlier annual reporting. The previously used reports can still be uploaded from Tuntinetti.

Pension reports

Download an electronic TyEL report file ().

...

Download a filled, annual or monthly tax report file in PDF format ().

Loading Income registers salary information form

...

manually

On the screen choose wanted period or time frame according to payment date as well as wanted units and employees.

On the upper right corner you can create a preview file from the preview button (). If there is several payment dates on the chosen time frame, you will get a .zip file that should be opened and save the files to your computer in .xml form.

This material you can control in tax offices ilmoitin.fi service in adress https://www.ilmoitin.fi/webtamo/sivut/AineistonTarkastus.

If the material is flawless you can take it manually in .xml form to Income Registers transaction services LoadingserviceYou can take material manually in .xml form to Income Registers transaction services Loadingservice.

The verification of the materials submitted to Income register for the download service is as follows:

1) When downloading the material notification, the service gives the user errors related to the material (schema).

2) Processing feedback is available from the download service after Income register has made all the checks in accordance with the processing of the material.

If no errors were found in the material, the status is "Saved in Income register". If there are errors in the material, the status is either “Rejected” or “Partially Rejected” depending on whether all or part of the material was rejected. The download service displays the time the material was received and a link to the processing feedback.

After the file is taken into Income Register you can mark it transferred using the button () . It is important to mark the files as transferred in Tuntinetti because you can't get a corrected file from Tuntinetti. The new file will replace the one that has been transferred earlier. If you haven't marked the files as transferred and get a new one, the Income Register will give you failure notification: "Payer already has a material that has the same payer's report reference". When you have marked the files as transferred you will get updated file from Income Register preview button.

...

| Info |

|---|

If customers accounting company delivers the file as an accounting company (through accounting companys Incomes register-account) on behalf of the customer then file format should be a bit different and you should deliver further information in Tuntinetti's customer support (company ID, address and username that is attached in accounting company who delivers information). If representative of accounting company is as a person directly in suomi.fi authorized to manage customercompanys information the file format doesn't require any changes as it is implemented in supposition that the company delivers information itself. |

...

Loading income registers employer's separate report manually

After the salary information forms are reported there is Income Registers employer's separate report that needs to be done monthly with button ().

Income Registers employer's separate report is not to be tested in ilmoitin.fi service. Employer's separate report can be taken manually into Income Registers transaction services Loadingservice.

If you take a report that replaces earlier report, you should create it from the button that makes the replacement material ().

Electronic export of salary information form

Electronic export of income register reports is a Tuntinetti’s paid feature. The guidance for retrieving the needed certificate can be found here. On the screen you should choose the wanted period based on the payment day and also wanted units and employees.

Electronic exports can be done from its button (), there will not be a separate transfer material but the information of salary information form will be transferred electronic from Tuntinetti to Income Register.

Electronic export of employer’s separate report

As an electronic export the employer’s separate report will be sent from Tuntinetti to Income Register from its own button ().

Payers report ID in Income Register report

Tuntinetti constructs automatically payers report ID in Income Register report. If Income Register doesn’t approve the new report and gives a note of payers report ID, act with following steps:

- Check from Income Register if the chosen salaries have been transported in Income Register. If the salary information has already been transported, but have been fixed after this, you should upload replace report for Income Register.

- If the salary information isn’t in Income Register, it is an exceptional fault condition. Guidance from Income Registers support is then transport the report without payers report ID (ReportID) by manually editing the XML-report (then Income Register will construct the payers report ID IRReportID). NOTE! This kind of report (that has no payers report ID) cannot be automatically controlled in Tuntinetti. With possible updates on report you should manually add Income Registers reference IRReportId (or do the updates directly to Income Register).

Downloading and printing in other formats

...

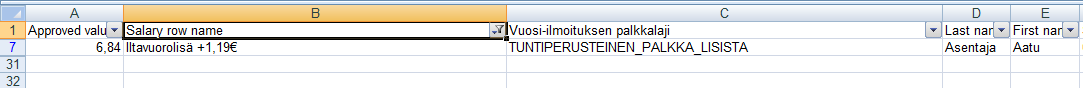

Whne this is done only the night shift information will be visible on the table.

Payroll ledger

Salary calculation > Payroll ledger

In Payroll ledger tab, you can form salary slip files in the same principle as period reports in the previous tab. Instead of period reports, salary slip will form below the filter menus. In the same way as in period reports; you first select the period or date range, then possibly the filters and finally unit(s) and employee(s). Then you can export the data in wanted file formats or print, by pressing the icons in the top part of the view.

...

- Download repeatable executions' data in Excel suitable form ().

- Download the salary slip in Excel suitable form ().

- Download the salary slip in PDF format ().

- Open page in a popup for printing ().

Salary lists

Salary calculation > Salary lists

Salary lists tab works in the same way as the period reports and payroll ledger. Salary lists form below the filter menus. Again, you first select the period or date range, then possibly the filters and finally unit(s) and employee(s). Then you can export the data in wanted file formats or print, by pressing the icons in the top part of the view.

...